Payroll

Luxembourg social parameters as of January 1, 2025

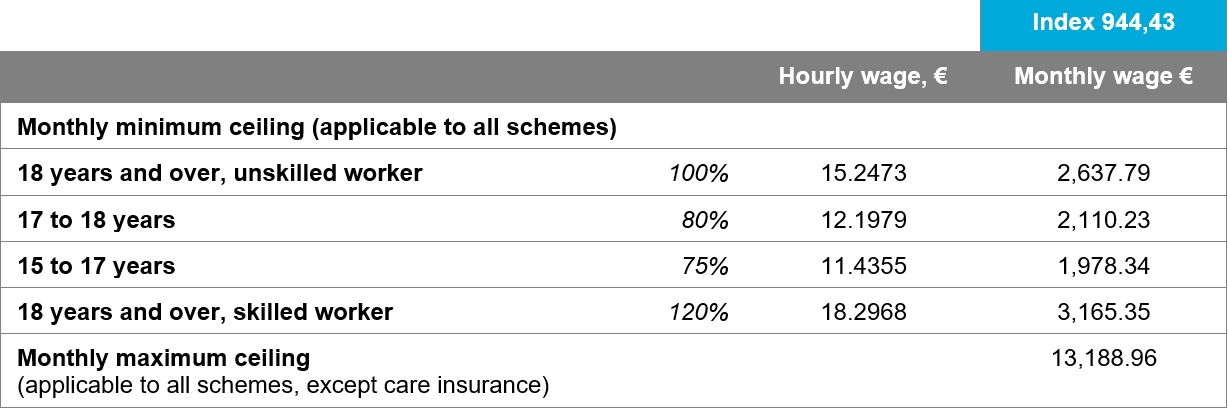

Minima social wage

Social minimum wage for pupils and students (during school holidays)

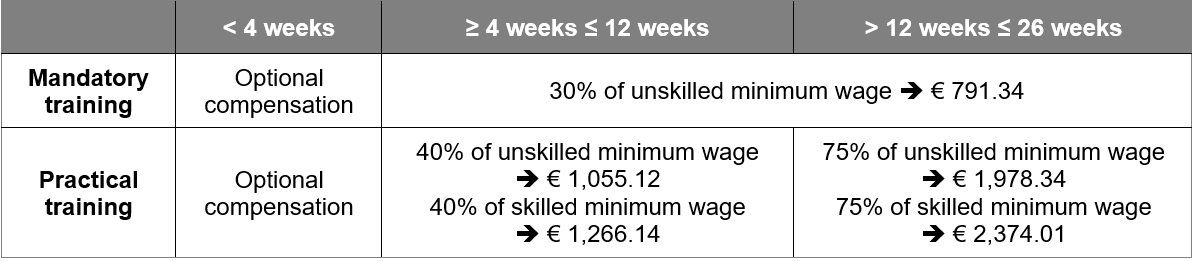

Trainee remuneration

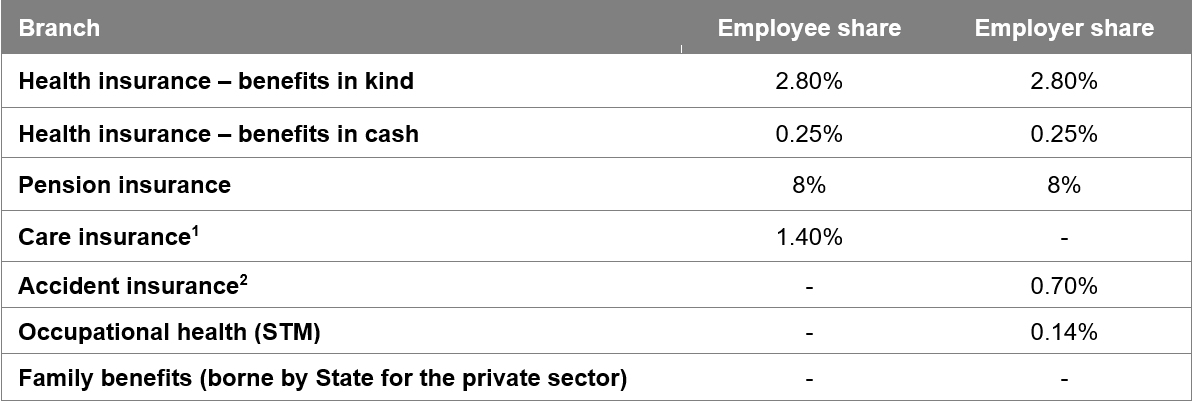

Social security contribution

1/ 1.40% of gross wages after deduction of an allowance corresponding to a quarter of the social minimum wage (€ 659.45).

2/ Base rate which can be increased or decreased depending on the bonus-malus factor awarded to the company by the Accident Insurance Association.

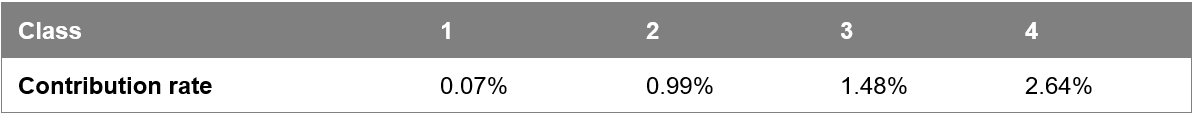

Employers' mutual insurance contributions

The following table provides contribution rates for the four risk classes in which companies were classified according to their financial absenteeism rate.

Family benefits

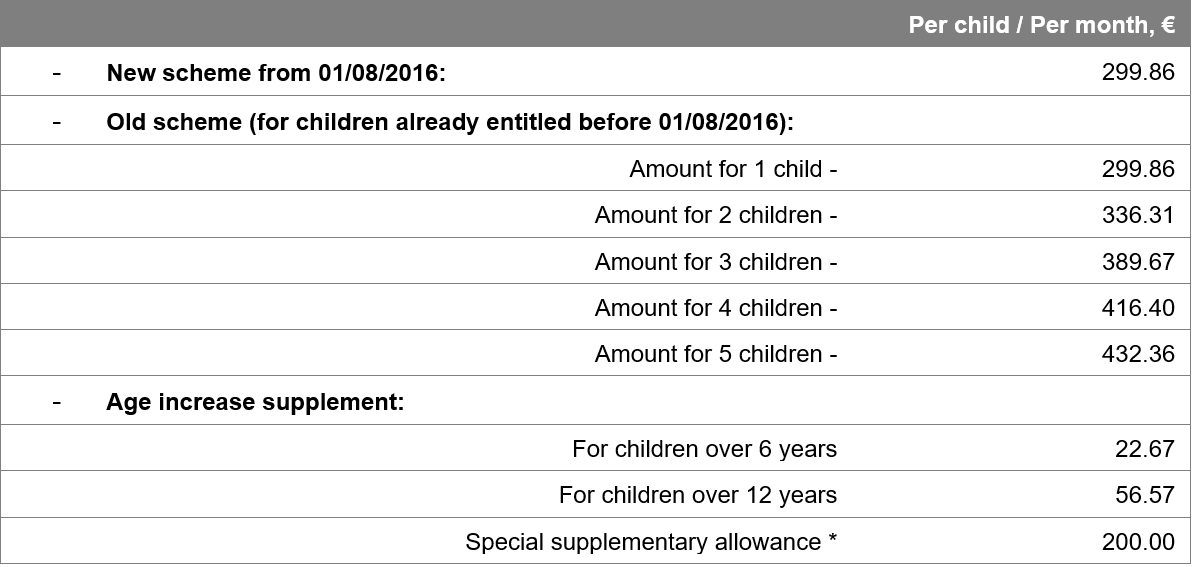

a) Family allowances

* Special supplementary allowance is an allowance for disabled children which is added to the child benefits.

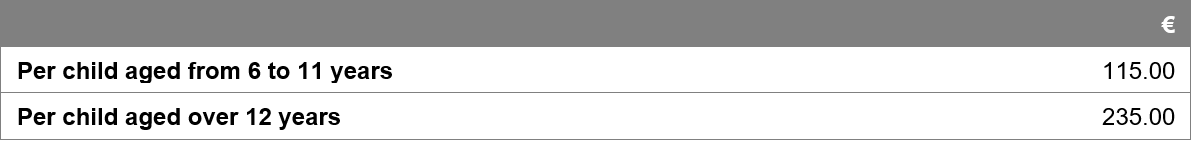

b) Back-to-school allowance (amount per child)

c) Birth allowance (3 instalments)

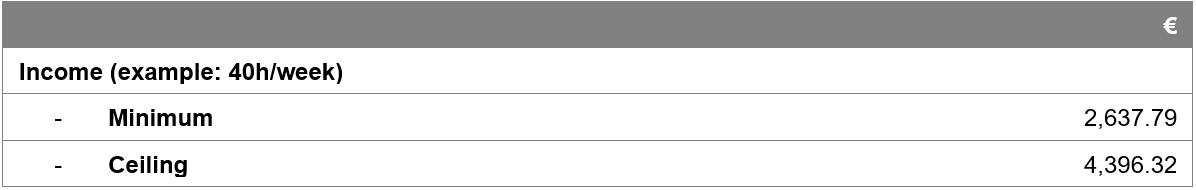

d) Parental leave - new refrom came into force on 01/12/2016

Need assistance?

Please do not hesitate to contact us for any questions or need for clarification!